Interest

is the applied mathematical concept for all financial computations from simple

interest loans to leveraged buyouts to pyramid/ponzi schemes. Only the interest

rate and compounding period vary, not the mathematical concept.

Interest

A sum paid or charged for the use of money or for

borrowing money expressed as a percentage of money borrowed to be paid over a

given period, usually one year.

Described

mathematically, compounding interest creates an exponential growth curve, which

starts out level and eventually curves infinitely straight up but never quite

reaches perpendicularity. As long as the

compounding period and interest rate are greater than zero, the resultant curve

is always exponential in shape given enough time.

Applying

an exponential growth concept upon anything has the expectation that the

anything will grow forever at an ever-increasing rate. Nothing physical can

grow perpetually at an exponential rate. Collapse is inevitable.

Interest

can be, and has been, applied to many forms of money. The form of money that

has prolonged growth attributes, such as gold, most facilitates the application

of interest. However, in the long run, not even gold and the other precious

metals could satisfy the growth demands; hence the emergence of fiat money.

Legal Tender, representing nothing physical, has far fewer constraints to

prolonged, compounded growth.

Interest

derived income - the growth portion of money - includes dividends, coupons, and

capital gains. Owners, Lenders and Investors are the beneficiaries of interest

income and capital gains on debt and investments. They differ only by priority

claims on cash flow, and they all want their money back eventually, plus more.

The

‘plus more’ portion is the implied expectation for money to grow. Faced with

the threat of seizure, foreclosure, eviction, and job security, Debtors and

Fiduciary Managers are motivated to make that growth happen to its extreme.

The

growth of money can be prolonged by using a lower interest rate and a longer compounding

period. But whatever the interest rate, there is still the inevitable limit to

exponential growth. A monetary system based on debt and compounding interest

must be forever growing. If growth ceases, it collapses catastrophically,

impacting all of society.

The Politics by Aristotle

Very much disliked is the practice of charging

interest; and the dislike is fully justified, for interest is a yield arising

out of money itself, not a product of that for which money was provided. Money

was intended to be a means of exchange; interest represents an increase in the

money itself.

Exponential Function

Exponential Function

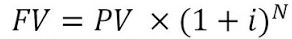

Future Value Function

FV = y = $ Future Value

PV = a = $ Present Value

1+i = b = 1 + interest rate

N = x = Number of Periods

This is the base mathematical

function for all financial computations from simple interest loans to leveraged

buyouts to rates of returns to pyramid/ponzi schemes. Only the interest rate

and compounding period vary, not the mathematical concept.

No comments:

Post a Comment